Ever struggled to pay a supplier with your credit card because they simply don’t accept it? If you run a business or work as a sole trader, you’ve probably noticed that many suppliers don’t accept credit cards. Even if they do, you don’t earn rewards.

Fortunately, you don’t have to rely on outdated payment methods. B2Bpay lets you pay suppliers with a credit card, even if they don’t accept them directly. Here’s how B2Bpay enables you to pay any supplier, regardless of their payment preferences, using your credit card.

We make it easy for your business to pay suppliers with your credit card—even if the supplier doesn’t accept credit cards directly. The process is as simple as 1, 2, 3.

Create and activate a B2Bpay account for payables, which takes just five minutes.

Add your credit card under the "My Wallet" tab.

After setting everything up, look for and choose your suppliers, or add a new a biller for payment.

Worried your supplier doesn’t accept credit cards? No need to worry. When you make a credit card payment through the portal, B2Bpay first receives the funds. Once the payment clears, it uses those funds to pay your supplier via BPAY or EFT.

The result? You can use your credit card to pay any biller, even those who don’t accept cards.

During this process, suppliers get paid in their usual way and don’t have to sign up for B2Bpay, change how they do things, or even know that B2Bpay is in the picture. This really sets us apart from our competitors and addresses potential concerns from users.

By using B2Bpay to pay suppliers who don’t accept credit cards, you maximise the interest-free period offered by your card. This allows you to use credit cards to cover a broader range of expenses instead of relying on business cash.

You can then pay off your credit cards from your bank account through B2Bpay and accumulate Qantas Frequent Flyer (QFF) Points just for paying off the card balance.

This gives you greater flexibility when managing your cash flow, especially when cash is tight. Using your card to pay more suppliers means retaining funds in your account longer, earning extra interest, and better controlling your outgoing payments.

It’s also a smart strategy for businesses handling day-to-day finances or juggling multiple expenses. By extending the payment cycle and freeing up working capital, businesses can handle their daily operations better, take advantage of early payment discounts, or even put money into growth opportunities.

At B2Bpay, you will always earn the maximum possible credit card points for all transactions based on the everyday spending rate. Unlike traditional card payments, there are no limitations imposed by the ATO or government departments when using our platform. When you pay suppliers with your card through B2Bpay, you aren’t directly paying the ATO, so there are no restrictions on earning points.

You can use credit cards to pay bills for businesses that don’t accept card payments. This allows you to use your cards more often and earn reward points that you typically wouldn’t have access to.

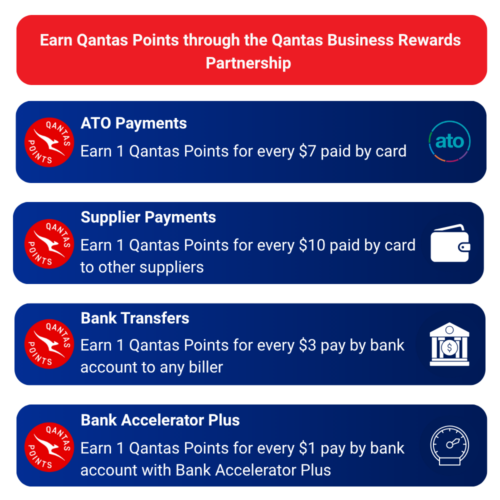

In addition to credit card points, you can also earn Qantas Points through our partnership with Qantas Business Rewards. With B2Bpay, you can earn points from government payments and billers. Here’s how it works:

– For every $7 paid by card to the ATO, you earn 1 Qantas Point.

– For every $10 paid by card to other suppliers, you earn 1 Qantas Point.

– For every $3 paid by bank account payment to any biller, you earn 1 Qantas Point.

Want to accelerate your rewards? For a small additional fee, you can earn 1 Qantas Point for every $1 spent when you use the Bank Accelerator Program.

We charge our customers only when they make a payment. There are no joining fees, ongoing costs, account-keeping fees, or membership charges.

B2Bpay will charge you only when you choose to make a payment, not your card provider.

Here’s a breakdown of the applicable transaction fees (all inclusive of GST):

Standard Payment Fees (inc. GST):

With Points Accelerator:

Want to earn more? The Points Accelerator option adds a fee to boost your rewards:

Let’s look at two common business scenarios to see how B2Bpay works in real life:

Sophie runs a logistics business and regularly makes payments to suppliers of around $15,000 per month. Using her Premium Business Visa card with Points Accelerator, she pays a 3.19% fee but earns 15,000-20,000 Qantas Points to cover regular domestic flights for site visits and meetings across her network. She also benefits from up to 55 days interest-free, helping her manage seasonal cash flow.

David, on the other hand, owns a recruitment agency and pays contractor invoices weekly, totalling $25,000 per month. Using a premium corporate Visa through B2Bpay’s standard payment option with a 1.70% fee, he earns approximately 2,500 Qantas Points each month. Over the course of a year, that adds up to 30,000 points, enough for multiple domestic flights to meet clients.

In both cases, the value is clear: Sophia chooses the Points Accelerator for maximum rewards, while David opts for the standard plan. Yet, they both walk away with enough points to fuel regular business travel.

So, is it worth it? At B2Bpay, we’re upfront with our fees- you only pay when you make a payment, with no hidden charges or ongoing fees. This makes it easier for you to see the costs and how they pile up against the benefits and cash flow advantages.

While there’s a fee to use our service, many businesses think earning Qantas points and having more payment flexibility is worth it. It’s a good idea to check out your payment habits and what you want to achieve to see if B2Bpay fits your needs. If you make the most of the rewards and keep up with your payments, it can be a valuable tool for your business.

At B2Bpay, we help businesses in all sorts of industries (from manufacturing to recruitment) find smarter ways to handle payments. Aussie businesses use our platform daily to pay suppliers, improve cash flow, and accumulate rewards. With a mix of flexible payment options, we make it easy for businesses to stay on top of their finances and get the most out of every transaction.

Don’t just take our word for it; see what our customers have to say about us!

Business/Situation: Jenny runs a small start-up business where cash flow is a real concern.

Challenge Goal: Jenny wants to use her American Express card to pay suppliers, but most don’t accept Amex.

B2BPay Solution & Benefit: Jenny easily opens a B2Bpay account and receives a welcome call to help her set up. She adds her Amex card to her B2Bpay wallet and starts paying suppliers who don’t accept Amex. This helps manage her cash flow while earning Amex points and Qantas points from B2Bpay for every transaction. When it’s time to pay off her card balance, Jenny also transfers funds from her bank account to Amex card services through B2Bpay, earning Qantas points just for settling her bill. Essentially, Jenny is able to “triple dip” on points. If she uses PayTo, B2Bpay can even settle payments to Amex on the same day or by the following business day.

Business/Situation: Anthony is a long-established business owner with high expenses, mainly in ATO tax bills and staff super contributions. He has accumulated a significant number of Qantas points and enjoys premium travel.

Challenge/Goal: Anthony holds a premium Qantas Mastercard that has a very high credit limit. This card earns him 2.5 Qantas points for every dollar spent on everyday purchases. However, when making payments to the ATO, he only earns half that amount in points. He also can’t use the card to pay staff superannuation contributions.

B2Bpay Solution & Benefit: Anthony easily opens a B2Bpay account and selects the ATO with no hassle. By using B2Bpay, Anthony pays his large ATO bills using his card and earns full points from his card provider. By choosing the Points Accelerator Plus option, he earns 1 QFF point for every dollar spent through B2Bpay. With assistance from the B2Bpay support team, Anthony also adds his staff superannuation provider, allowing him to earn full points again. Once more, by selecting the Points Accelerator Plus option, he receives 1 QFF point for each dollar spent.

Business/Situation: Johan and Vanessa run a thriving electrical contracting business. Johan works on-site, while Vanessa manages the bookkeeping and invoicing via Xero.

Challenge/Goal: Vanessa manages hundreds of outgoing bills and needs a more efficient way to handle them. She wants to reconcile easily while improving cash flow and maximising rewards.

B2Bpay Solution & Benefit: After some research, Vanessa registers for B2Bpay and, following a welcome call and demo, integrates it with Xero. She adds credit cards and a bank account to her wallet. Bills created in Xero are exported to B2Bpay, and at month-end, she pays them from the “My Xero Bills” tab. Payments auto-reconcile in Xero, making it straightforward and hassle-free.

After a few months, she also activates a B2Bpay merchant account to accept credit card payments at no cost. After a quick walkthrough of her receivables page, she starts invoicing clients immediately. Now, she earns points for all her outgoing bills and has funds coming in, all at no expense to her business.

Getting started with B2Bpay is quick, easy, and secure. In just a few simple steps, you can enhance your credit card benefits and start collecting rewards simultaneously.

Create your account in less than 5 minutes

Connect your suppliers effortlesly

Make payments and watch your rewards grow

Ready to get started? One of our friendly team members can assist you with setting up your account during a demo.

Click here to schedule your demo now:

Enter YOUR DETAILS

And our team will be in touch to get you started!

Enter YOUR DETAILS

And our team will be in touch to get you started!

Let’s get you started below..

1. Simply enter your details below.

2. We will be in touch to get you started receiving card payments through B2Bpay shortly.

1. Simply enter your details below.

2. We will be in touch to get your started making and receiving card payments through B2Bpay shortly.

It’s simple.

1. Fill in the form below & we will get back to you requesting some more details and your logo

2. We will then set up your account and payment page.

3. Finally we will help you get a ‘pay now’ link on your invoices that will direct to your payment page.