Paying Suppliers with a Credit Card

Ever struggled to pay a supplier with your credit card because they simply don’t accept it? If you run a business or work as a

Ever struggled to pay a supplier with your credit card because they simply don’t accept it? If you run a business or work as a

In today’s competitive business environment, selecting the right payment platform is critical. While Stripe has long been a popular choice, more and more Australian businesses

At B2Bpay, we’re committed to continuously enhancing our services to help our customers manage their business expenses effortlessly and earn rewards. We have now enhanced

Google Ads users have recently been notified that Google is changing the billing options for Google Ads accounts. Many Australian businesses will need to switch

Fly in Style with B2BPay and Qantas Classic Plus Flight Rewards Dreaming of luxurious travel experiences? With B2BPay and Qantas Classic Plus Flight Rewards, your

Time-Saving Hacks for Small Businesses As a business owner, your time is valuable. From admin and emails to customer-facing roles and product testing, there are

Make it easy for your tenants to pay their commercial rent using B2Bpay Managing commercial real estate can be a complex endeavour, especially when it

PayID: Securing Everyday Transactions for Australian Businesses As more businesses continue to operate in a digital landscape where fraud, hacks and scams are ripe, protecting

It usually takes more than one person to run a successful business. So it makes sense that we have received many requests for multiple customers (payable) to be associated with one business profile.

Understanding the Consequences of Delayed Payments Small businesses lose a potential $1.1 billion every year to payment delays, and the sad truth is that some

New B2Bpay Security Feature: Bank Account Verification In recent years, there has been a rise in digital hacks, scams, and fraud. The widespread adoption of

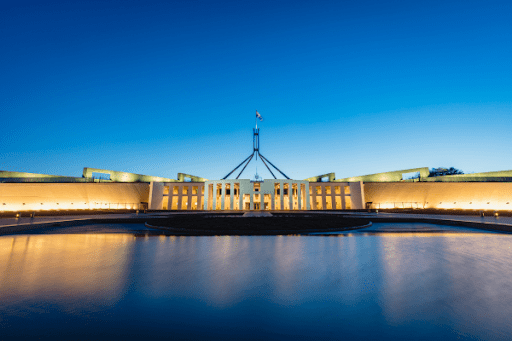

5 Ways SMEs Can Take Advantage of the New Federal Budget The 2023-24 federal budget has announced several new incentives that small and medium enterprises

Guide: Simplify Your Business Payments with MYOB Integration on B2Bpay Are you an MYOB user who is tired of manually reconciling payments made to your

Using Xero and B2Bpay In Your Business If you own a small business, chances are you use accounting software like Xero. Adding B2Bpay to your

Using Reward Points For Corporate Gifting In the world of corporate gifting, finding the perfect gift can be a challenging task. You want to find

Accepting Credit Card Payments Accepting credit card payments can suit any business, big or small. Credit card payments have been the go-to for consumers due

How Quickly Can My Business Earn Two Return Flights To London? As a small business owner, you deserve to reward yourself for your hard work

What Are Qantas Reward Flights and How to Book Them If you’re looking to maximise the value of your Qantas points (and chances are, if

How To Turn Business Expenses Into Business Class Flights As a business owners your hard hard deserves to be rewarded every once in a while.

How To Best Use An American Express In Your Business Did you know that spending on AMEX can earn you more points through B2Bpay? In

Meet The B2Bpay Sales Team At B2Bpay we are proud to house our entire sales and support team here in Australia. Our sales team is

Protecting Your Business From Fraudulent Payment Activity Payment fraud is a big problem for businesses, particularly in the online era; the ACCC estimates that Australians

Maximise your Qantas Frequent Flyer points with our Bank Accelerator Program Say goodbye to capped points earning when you use credit cards. B2Bpay’s Bank Accelerator

Why We Keep B2Bpay On-Shore Here at B2Bpay, we are proud to be an Australian business through and through. Every member of our team, from

Enter YOUR DETAILS

And our team will be in touch to get you started!

Let’s get you started below..

1. Simply enter your details below.

2. We will be in touch to get you started receiving card payments through B2Bpay shortly.

1. Simply enter your details below.

2. We will be in touch to get your started making and receiving card payments through B2Bpay shortly.

It’s simple.

1. Fill in the form below & we will get back to you requesting some more details and your logo

2. We will then set up your account and payment page.

3. Finally we will help you get a ‘pay now’ link on your invoices that will direct to your payment page.